The Cotlook Indices – an explanation

Cotton Outlook has been publishing representative prices for the principal growths of raw cotton for almost sixty years. In 1966, the forerunner of what is now the Cotlook A Index was introduced. The initial value was 27.60 cents per lb.

The COTLOOK A INDEX is intended to be representative of the level of offering prices on the international raw cotton market. It is an average of the cheapest five quotations from a selection of the principal upland cottons traded internationally. Taking the average of the five cheapest quotations is a tried and tested means of identifying those growths which are the most competitive, and which therefore are likely to be traded in most volume. This practice is a proxy for weighting, which is impractical, owing to the absence of timely data by which it could be calculated. Changes in the selection are made solely to reflect shifts in the cottons most frequently traded. The base quality of the A Index is MIDDLING 1-1/8″.

As from August 1, 2004, the geographical basis of the quotations used in the A Index is the FAR EAST. The destinations taken into consideration include all of the major recipient ports for which no significant freight surcharges exist (including Bangkok, Laemchabang, Jakarta, Hong Kong, Penang, Kelang, Singapore, Busan, principal Japanese and Chinese ports, Manila, Tainan, Keelung, Semarang, Surabaya). Minor freight differences for other destinations are taken into account. The terms quoted are Cost and Freight (CFR), Letter of Credit at sight, including one percent agent’s commission and notional profit.

The Indices are published in the weekly Cotton Outlook and in a variety of different daily services tailored to meet specific market needs.

History

The A Index has progressed through many changes in its fifty years of history, from CIF Liverpool, to CIF North Europe, and now to CFR Far Eastern ports, from SM 1-1/16” to Middling 1-3/32”, and from August 1, 2015, to Middling 1-1/8″. Cotlook regards the change in location and staple length as transitions that validly reflect today’s trading patterns. Our aim is to ensure that the A Index maintains its unrivalled position as the leading barometer of international cotton price movements.

Daily Quotations

The Cotlook Indices are calculated from the prices at which cotton is offered to the final consumers, i.e. mills. Cotlook indicates a representative quotation for each component of each Index. If evidence of offers is slim, a component may be denoted as ‘nominal ‘ or withdrawn.

Offering prices are monitored each UK business day and are published, together with the day’s indices at about 2.30 pm UK time. From January 19, 2015, public access to the Cotlook A Index follows 18 hours after release to subscribers. Since the quotations are intended to reflect the competitive level of offering prices, not the level at which business has been arranged, a mill buyer would normally expect to succeed with bids that were slightly lower.

It is from these daily quotations that the COTLOOK A Index is calculated.

The Cotlook Indices are acknowledged by the trading fraternity, governments, and international organisations such as UNCTAD and ICAC, as accurate measures of the fluctuation of international raw cotton values. Several producing countries incorporate the indices, or elements thereof, into national farm legislation.

The Cotlook A Index

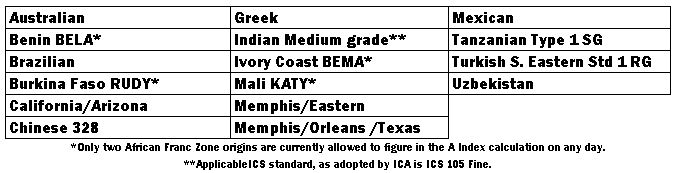

The A Index is calculated by taking a simple average of the day’s cheapest FIVE of our Far Eastern quotations. The growths currently in the SELECTION for the 2023/2024 A Index are as follows:

The Cotlook North European A and B Indices were discontinued as from August 1, 2008.

Growths are occasionally added to or withdrawn from the SELECTION, following the provision of appropriate notice of our intentions, as the quality and availability of cotton from the various countries change.

The Dual System

In arithmetical terms, the manner in which we calculate the Indices has remained unaltered since their introduction: each is a simple average of the cheapest growths.

However, since 1988, the original practice of replacing old crop by new crop values, gradually, in a single series of prices, was abandoned, in favour of a Dual Index system.

Under the Dual System, two sets of indices (one reflecting nearby quotations of the current season, the other forward quotations, of the next season) run concurrently from the establishment of the forward indices until the end of the marketing season in question on the last business day of July. At that time, the existing Current Indices disappear, and the existing Forward Indices are transformed into the new Current Indices. Those Indices will alone be published until early the next year. As soon after January as is possible, a forward value is established for each growth, for shipment no earlier than October/November of the coming cotton season. In deciding when to introduce it, we are influenced only by the degree of confidence that we place upon its validity. When sufficient forward values have been introduced, they are consolidated into the relevant Indices. No specific date is set for this step, which depends on market circumstances.

Forward Indices have been introduced as early as the February and, in the case of the former ‘B’ Index, as late as July. October/November (rather than August/September) is chosen as the initial shipment period, since it is during these months that the Northern Belt crops begin to move in volume. SOUTHERN BELT values are ignored for Index calculation purposes before January 1, whether appearing on our price lists or not.