October 2024 Market Summary

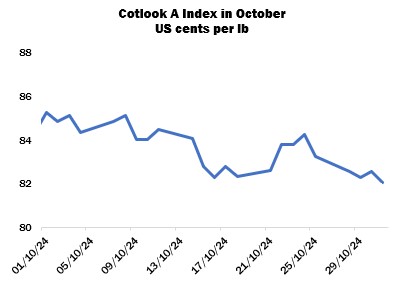

International cotton prices, as measured by the Cotlook A Index, began October at 85.25 cents per lb and declined to 82.05 by the end of the month, a loss of 320 cent points. The bearish trend reflects movements in New York: the December contract lost 352 points in the same time frame, to close October at 69.57 cents per lb – its lowest settlement since early September.

Price dips during the month encouraged a greater level of mill demand from several markets, most notably Pakistan, Bangladesh, Vietnam and other Far Eastern countries. Buyers in Bangladesh issued bids for the customary West African and Brazilian supplies, while the latter origin was sought after in Pakistan and Vietnam, as well as lower grade US lots and recaps. US supplies also attracted interest in Turkey, although the volumes under discussion were thought to be modest.

Nonetheless, the approach of many mills to purchasing remained price-sensitive and of a hand-to-mouth nature to cover nearby gaps in requirements. In addition, the protracted difficulties associated with opening Letters of Credit and making timely payments continued, most notably in Bangladesh, although improved stability in that country following several weeks of civil unrest and a change of government over the summer has allowed for some cautious optimism that the situation may improve somewhat.

Beyond nearby covering, many buyers were unwilling to commit to purchases further ahead as they awaited both a clearer price direction and an uptick in downstream demand, as well as the outcome of the United States presidential election. The potential for tariffs of 60 percent on all imports from China and 10 to 20-percent duties on products from elsewhere, plus the possibility of retaliatory actions, raised concerns that global trade may be subject to substantial difficulties, and that demand for textile products in the US will be further dampened in the event that prices rise as a result. Retaliation from Beijing could target agricultural products including cotton, as was the case in 2018, placing in jeopardy China’s position as an import market for US supplies at a time when competition from Brazil is increasing.

Upon return from the national week-long holiday at the start of October, the Zhengzhou cotton futures platform in China lost ground, the January contract falling by 490 yuan over the month to close on October 31 at 14,050 yuan per tonne. Harvesting approached a conclusion in Xinjiang and almost 1.8 million tonnes had been ginned by the end of the month, up significantly from the same date a year earlier.

Meanwhile, the USDA again cut its forecast of domestic cotton production in its October supply and demand report, bringing the figure to 14.2 million 480-lb bales, down from the 14.51 million put forward in the previous month. The downward adjustment reflected in part the damage caused by Hurricane Helene to cotton in the Southeast, primarily Georgia and North Carolina. The Department, however, noted that further reductions are possible in that regard as the scale of the impact becomes clearer. By October 27, beltwide harvesting was placed at 52 percent complete, ahead of the previous year and the five-year average. Crop conditions improved slightly over the month, with 33 percent classed as ‘good’ to ‘excellent’ by the same date.

Picking also advanced in Pakistan under generally favourable weather, thus allowing a greater availability of local cotton for spinners in addition to imported supplies. The Pakistan Cotton Ginners’ Association reported that seed cotton arrivals totalled almost 4.3 million lint-equivalent bales by October 31, below the volume delivered by the same date in 2023 but higher than that in 2022.

In India, arrivals also picked up as the month progressed, reaching over 100,000 bales per day earlier in the season than usual. Observers meanwhile considered the prospects for buying by the Cotton Corporation of India in defence of the Minimum Support Price (MSP). Earlier estimates of possible total procurement ranged from eight to 18 million bales, but the rise of ICE futures in the second half of September served to scale back assessments to perhaps six to eight million. Of course, that rise was moderated by October’s decline, and it is felt that further weakness in ICE futures may encourage more import enquiry, and MSP buying could then surge as arrivals accelerate.

The wet weather that had disrupted field work in Greece for several weeks gave way to clearer conditions in the middle of the month, allowing harvesting to progress to about 85 percent complete by the end of October. However, unhelpful conditions throughout the growing season and a higher incidence of pest infestations are thought to have affected the quality composition of the crop and have resulted in substantial losses both in that country and in Spain.

In the Southern Hemisphere, sowing approached a conclusion in Australia and young plants were developing well overall, so expectations of output remained largely positive. Meanwhile, the outlooks for planting in Brazil and Argentina were broadly optimistic. Logistical difficulties were in focus as ever in the former country, compounded by strike action at the port of Santos (the primary dispatch hub for cotton) at the end of the month. Nonetheless, export shipments up to October 25 were robust at almost 260,000 tonnes, up around 15 percent from the same month last year.

In October, Cotton Outlook increased its forecast of world raw cotton output in 2024/25 by 40,000 tonnes, to 25,325,000. The adjustment is a result of higher figures for China and India, offset partly by reductions for the United States and smaller producing countries. For consumption, our estimate was raised by 94,000 tonnes to 24,389,000, attributed primarily to Bangladesh (partially offset by a decrease for the US). World stocks at the end of the current season are therefore expected to rise by 936,000 tonnes, down from the 990,000-tonne increase put forward a month ago. Modest adjustments were made to the figures for 2023/24, with the result that the margin by which production is estimated to have exceeded consumption in that campaign has also been reduced slightly, to 936,000 tonnes.