May 2023 Market Summary

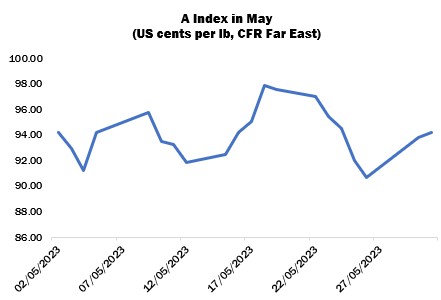

International cotton prices as measured by the Cotlook A Index ended the month of May as they began it – at 94.15 cents per lb. Of course, the period in view was not without volatility, but since the prevailing macro-economic conditions showed no sign of improvement, a lack of demand was the principal characterising feature of the market. Nevertheless, there was a moderate boost to cotton prices mid-month, coinciding with growing optimism in US financial and commodities markets that a bi-partisan agreement would, after all, be achieved on the issue of the debt ceiling. The decline during the subsequent week was also attributed to developments in the States – this time of a fundamental nature. May is typically the end of the spring rainy season in West Texas and precipitation in the second half of the month was both fairly heavy and widespread, encouraging greater optimism with regard to the outlook for US production than had been apparent for some time. The highest position of the A Index was 97.85 on May 18 and it fell to a low of 90.65 cents per lb on May 26.

As alluded to above, the conditions in the downstream textiles sector showed little to no sign of improvement in May. Orders from retailers and brands were acknowledged to be for smaller quantities than usual and with much shorter lead times, and in various markets textiles manufacturing showed signs of stress. In India, for instance, some weavers and knitters in the major production centres of Tamil Nadu cut operations to 50 percent of capacity in the face of wavering demand from export markets and also now domestic consumers, which up to that point had insulated the country from the most acute problems as experienced in the textiles sectors of neighbouring Pakistan and Bangladesh. In China, the post-Covid recovery in the spring of 2023 was slower and weaker than had been envisaged when all restrictions on movement were removed in November 2022. In May, a second consecutive month of contraction was registered by the Purchasing Managers Index for manufacturing.

Nevertheless, China was certainly the most active import market for raw cotton during the month. In total, 454,700 bales of US upland were registered for shipment to that destination (from 778,300 overall) in the current season between April 28 and May 25, according to USDA, and purchases of Brazilian and Australian were noted by market observers as well. However, it remained the case that buyers were extremely price conscious and securing business was often only possible when merchants were prepared to give further ground on basis. It is noteworthy, too, that much of the purchasing was undertaken by trading organisations – whether private or state-owned – implying perhaps that the recovery in buying interest did not immediately imply an increase in consumption by mills. Rather, it was suggested that traders were keen to take advantage of the much more competitive appearance of international cotton rates, banking on an increase in demand from spinners later in the year. The shift in the relationship between local and foreign supplies came about as a result of the rise in local prices and the further collapse of basis for supplies from the US, Brazil, Australia. In the latter two markets, the weakness was compounded by the weight of the new crops (arrival of which was imminent in May), and especially the sizeable long positions taken by traders in the Brazilian crop that were becoming increasingly burdensome as they struggled to make forward sales to mills

In our monthly review of global supply and demand, the estimate for production in 2022/23 was downgraded by 69,000 tonnes overall. Increases in China and Australia (reflecting the encouraging ginning figures from Xinjiang and growing optimism for outturn as harvesting progresses in the latter country) were more than offset by further reductions for West Africa (where the crop has been ravaged by insects known as jassids) and US (based on ginning data). The total figure for the season ahead was raised incrementally, reflecting first of all a substantial increase to forecasts in the US, where the aforementioned rain in Texas prompted a less pessimistic view of abandonment. On the other hand, a difficult start to the growing season in China on an area substantially lower than last year provided the basis for a further cut to output, while drought in Spain moderated expectations there too.

Reductions in consumption were envisaged for both the current and coming seasons in South Asia. Various, persistent problems in the economies of Bangladesh and Pakistan have been pressing for some time, and May came and went with yet again no sign of improvement. Meanwhile, as discussed above, the situation in India began to seem more challenging. In total, the forecasts of raw cotton consumption were cut by 370,000 tonnes for 2022/23 (spread across the three countries, with a greater focus on India and Pakistan) and by 240,000 for 2023/24.

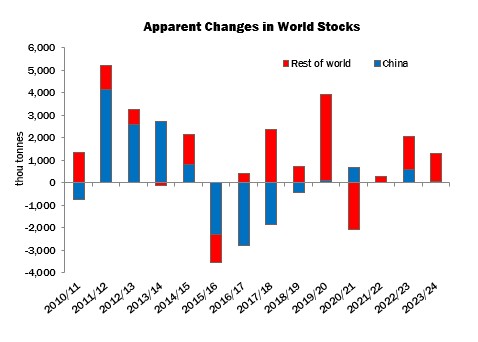

In light of these adjustments, stocks were forecast to increase by a greater margin in both the current and coming season. The rise for 2022/23 was estimated at 1.98 million tonnes (up from 1.67 million in April), while for 2023/24 it was 1.13 million (885,000 the month before).