June 2024 Market Summary

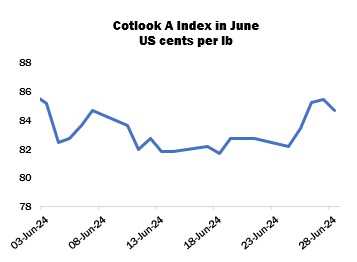

International cotton prices as measured by the Cotlook A Index declined modestly during June. In the middle of the month, the A Index fell to its lowest position since December 2020, before regaining some ground to end the period at 84.70 cents per lb, a reduction of 210 cent points from the end of May.

The downward movement of prices early in the period continued to be attributed in part to speculative selling, rather than fundamental considerations. However, the release of USDA’s Planted Acreage report on June 28 provided further downward impetus, more of which below.

As for physical demand, mills remained largely wedded to their hand-to-mouth approach to fresh purchases, despite reports that inventories are low across much of the sector. Downstream demand showed few signs of recovery and many spinners continued to complain of negligible margins from sales of cotton yarn. In addition, the protracted difficulties in obtaining Letters of Credit remained a challenge in certain countries (most notably Bangladesh and Pakistan, but also increasingly Vietnam).

However, the availability of better quality and machine-picked lots for nearby shipment tightened further as the month progressed. Australian higher grades were not offered with great frequency by shippers, as the wet weather received throughout the latter part of the growing period had raised concerns regarding the quality composition of the crop, while merchants’ unsold supplies from the US and Brazil tended to be composed of cheaper lots or recaps. Franc Zone supplies, meanwhile, were still difficult to procure from origin, as sellers’ price ideas were considered unworkable by trade buyers. A further complication arose from the congestion at ports that continued to be reported in many locales. Whether the orders made for delivery in the fourth quarter of this year will arrive on time is in some cases open to question.

The upshot of all the foregoing was that mills seeking higher grade supplies for nearby delivery were in many cases required to pay a premium. West African and Brazilian lots continued to encounter demand in Bangladesh and Vietnam, while spinners in Pakistan were focused primarily on cheaper cotton from a range of origins. In the last-mentioned country, a strike by the Ginners’ Association (in response to tax and energy changes laid out in the federal budget) led to a firming of local prices and increased interest in imports. The industrial action was subsequently postponed for one month, and farmers rushed to transport their seed cotton to gin yards before the strike recommenced.

The announcement by the Indian government that the Minimum Support Price for seed cotton in 2024/25 will be increased by around seven percent also prompted some import demand from that country, as the already relatively high values in circulation for local lint were supported further.

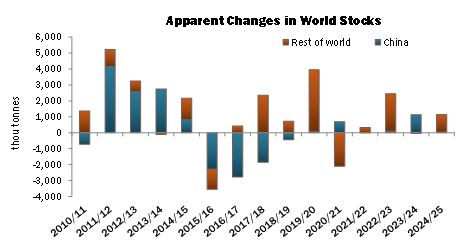

Conversely, mills in China can draw from the abundant supplies already stationed in the country to fulfil their requirements, while the arrival of the local new crop is on the horizon. Hence, import demand from that quarter was at a low ebb during the month. Although the price relationship between local and international supplies showed a distinct advantage for overseas lots (more than 1,200 cent points per lb at their widest, on June 11), availability of import quota is thought to be tight, and the price incentive appeared not to be great enough to encourage a more active level of demand.

According to USDA export reports released during June, China accounted for around 243,000 running bales of new net upland sales registrations for shipment in the current season. That represented 43 percent of the total to all destinations, down from 60 percent in the previous month.

Washington’s assessment of US exports in 2023/24 was reduced in its June supply and demand report to 11.8 million statistical bales, while the projection for 2024/25 was unchanged at 13.0 million. However, the latter figure may come under scrutiny in USDA’s next bulletin, as well as the number for output, following the release of the Planted Acreage report. US cotton area was placed at 11.7 million acres, almost one million above the number put forward in the March Prospective Plantings report. Cotton Outlook’s number for US production next season has been increased to almost 3.7 million tonnes, to reflect the higher area figure.

Elsewhere in the Northern Hemisphere, sowing is complete in Pakistan, on a reduced area. Plant health was reported to be fairly good, but total output is expected to fall from the current season. In India, planting was behind schedule by the end of June, progress having been slowed by sustained high temperatures and deficient rainfall from the Southwest Monsoon. In Turkey, meanwhile, a recovery of production appears in prospect. Our figure has been increased accordingly.

In the Southern Hemisphere, picking expanded under good weather in Brazil and a bumper crop remains in prospect. A substantial upward adjustment was also made to our figure for 2024/25 reflecting an increase in expectations of area.

Cotton Outlook’s estimate of world raw cotton production in 2023/24 was raised by 99,000 tonnes in June, attributed mainly to India, where arrivals data prompted an upward revision. For 2024/25, our forecast was increased by 425,000 tonnes, owing to higher figures for Brazil and Turkey. Consumption forecasts for both seasons remained unchanged, at slightly over 24.0 and 24.7 million tonnes, respectively. Thus, global ending stocks are expected to rise in line with the upward adjustments made to our production estimates.