July 2024 Market Summary

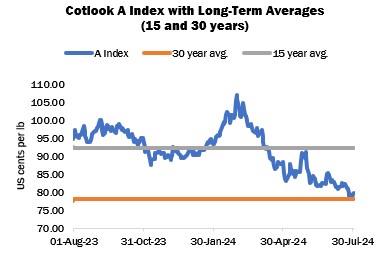

Under the lead of New York futures, international cotton prices as measured by the Cotlook A Index declined overall during July. The Index reached its lowest point since December 2020 on July 29, at 78.35 cents per lb. The high point for the season of 107.00 cents per lb (well above long-term averages) was reached at the end of February.

With the end of the 2023/24 season, the 2024/25 A Index will stand alone until a Forward (2025/26) Index is introduced after the turn of the year.

Factors that influenced the bearish mood in New York included sell-offs in equity markets, the relatively good condition of the US crop and the statistical outlook for the 2024/25 marketing year.

Crop health across the United States cotton belt was slightly poorer than at the start of the month, but still considered satisfactory. USDA placed the proportion of the crop rated ‘good’ or ‘excellent’ on July 28 at 49 percent, better than the previous season and level with the five-year average. Plant development was reported as ahead of the normal pace.

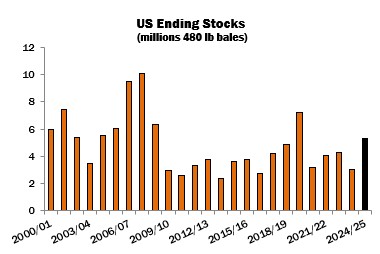

As expected, the Department increased its domestic production figure for 2024/25 by one million bales (480 lbs) to 17 million in its July supply and demand bulletin, in line with the higher area figure reported in the previous month’s Planted Acreage report. Since exports were unchanged and beginning stocks were revised upward, the forecast of US ending stocks in 2024/25 was raised substantially, from 4.1 to 5.3 million bales. That would be the largest carryover since the Covid-affected 2019/20 season and the second highest of the past fifteen years.

A further contributor to the bearish mood was the growing apprehension that import demand from China during the season ahead is unlikely to match the levels witnessed in 2023/24 – a twelve-year high of 3.2 million tonnes, according to Cotton Outlook’s latest forecast. On July 31, the National Development and Reform Commission announced an allocation of 200,000 tonnes of Sliding-Scale import quota for 2024. All the quota must be applied against processing trade imports, for use in goods destined for export only. Spinning mills with 50,000 spindles and above were invited to apply from August 1 through 7. The reaction of both local and international markets was muted, as a larger and less restricted allocation had been expected.

China’s Zhengzhou cotton futures platform also observed a weak trend during July, the September delivery posting a life-of-contract low on July 25 at 14,085 yuan per tonne, before recovering a very modest amount of ground.

On most major markets, demand in the physical market was largely subdued and sporadic for much of July, much like the pattern observed in June. However, the falls of futures as the month progressed encouraged a slightly greater level of buying to cover nearby needs and fixations against on-call purchases. Some enquiry was in evidence from China and Far Eastern markets including Vietnam, for Brazilian lots for example, although price ideas were at times difficult to reconcile.

In Bangladesh, unrest developed over the month in protest at government job quotas. The authorities’ response resulted in the closure of businesses and services including banks and factories, as well as the restriction of the internet and communications for several days. As a result, garment manufacturers reported significant costs in lost production and delayed shipments.

Buyers in Pakistan sought lower grade international supplies in view of higher local prices and slow arrivals, but Letters of Credit were still difficult to open for some and lengthy transit times also weighed on purchasing decisions. In India, local prices were also much higher than international levels. Thus, buyers there issued enquiry for cotton from a range of origins, including West and East African lots, especially those that benefit from a 50-percent import duty reduction. The disparity between local and world prices is expected to sustain import demand into next season. An increased Minimum Support Price for seed cotton in 2024/25 was announced last month and cotton area is expected to decline.

Merchants’ positions in Franc Zone supplies remained depleted as availability at origin was low in many countries and in those with cotton still to sell price ideas were often considered unworkable. Furthermore, as we reported last month, congestion at various ports and transit delays made timely shipments difficult.

In India, 10.5 million hectares had been sown to cotton by July 25 according to the Department of Agriculture and Farmers’ Welfare, behind last year’s pace. Meanwhile in Pakistan, new crop arrivals began to gradually pick up pace despite some rain-related disruptions. Daily arrivals were estimated at around 25,000/30,000 bales in the latter half of the month, lower than the quantities delivered a year earlier.

In Greece, the prospects for yields are viewed with some optimism. Prolonged heatwaves have spurred crop development and harvesting is expected to commence in late September. However, new crop marketing was mostly stagnant during the month as producers’ price ambitions diverged from those buyers were willing to pay.

In the Southern Hemisphere, picking in Australia was all but complete by the end of July, according to the Australian Cotton Shippers Association, while ginning and classing were around 50 and 40 percent complete, respectively. Harvest work also approached conclusion in Argentina, while in Brazil roughly a quarter of fields had been picked by late July. The official agency CONAB reduced its output forecast very modestly on account of lower yield expectations in Mato Grosso, but the revised figure would still represent a record by some margin.

Cotton Outlook’s forecast of global raw cotton production in 2024/25 was lowered by 330,000 tonnes in July, as a result of reductions to the figures for India, Pakistan and the African Franc Zone, partially offset by an increase for the United States. Therefore, the projected surplus for that season is slightly smaller than the figure put forward last month, at 767,000 tonnes. For the 2023/24 season, a modest decline was made to our world output estimate, while consumption was unchanged. Thus, the margin by which production is estimated to have exceeded consumption has narrowed to 1,067,000 tonnes.