April 2023 Market Summary

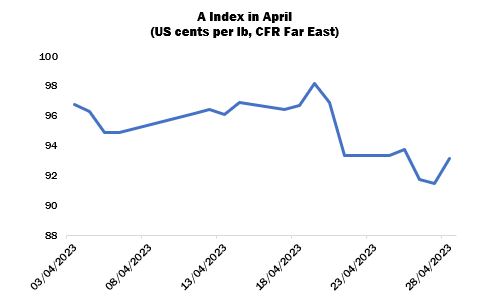

International cotton prices as measured by the Cotlook A Index continued to decline overall during April, falling into the low 90s US cents per lb towards the end of the month, before an encouraging US export report stimulated a sharp upward move on the last day of the period in view. In general, cotton prices seemed to come under the influence of the worsening macro-economic picture. The International Monetary Fund’s April forecast for global economic growth this year was downgraded to 2.8 percent overall, and 1.3 percent in advanced economies. However, the organisation acknowledged a “plausible alternative scenario” in which instability in the financial sector (following several US bank failures this year) could create additional stress and reduce the headline figure to 2.5 percent and the measure for advanced economies to below one percent. The A Index registered its highest point for the period on April 19 (98.15 cents per lb) and fell to a low of 91.45 on April 27.

Mill purchases of raw cotton continued in the somewhat lacklustre fashion seen for some time. An additional influence on spinners’ buying decisions – on top of the general lack of downstream demand – was this year’s sharply higher costs for finance, interest rates having been raised in an effort to rein in inflation. In general, mills were disinclined to build and carry large inventories of raw materials, especially given that yarn orders and the prices achievable were so low. Nevertheless, in the second half of the month, the decline in international offering rates once again saw the gap between prices for domestic and imported cotton in China converge and then the latter offered at a slight discount, which prompted a considerable increase in interest in overseas origins, most notably US and Brazil, from state-owned or private trading organisations.

Accordingly, US export registrations from China rose sharply late in the month, with upland sales to that market in the week to April 27 amounting to more than the previous three weeks put together. Brazilian was also thought to have featured in the business with Chinese buyers, although the volumes involved were much more difficult to quantify and track. Overall, sales of US upland for the current season registered by the last week in April amounted to almost 631,500 running bales, and those of Pima to 98,819. Shipments were very strong: 1.44 million running bales of upland were dispatched in the four weeks covering April, and over 71,000 of Pima.

The substantial expansion of trade in Pima coincided with the introduction of a Competitiveness Payment, since offering rates for the major competing growth (Giza 94 from Egypt) underwent an additional decline. For the four weeks in view, a payment ranging in value from 56 to 60 cents per lb (depending on the relative values of Pima and Giza cotton during the weeks in question) was applicable to cotton dispatched between April 7 and May 4.

Meanwhile, the interest in Brazilian upland varieties arose in part from the competitive basis levels offered by merchants holding substantial long positions in that origin. Faced with a structure of the board in New York that was not conducive the carrying of cotton into the months ahead, traders were keen to lessen their exposure to a bumper crop (in the region of three million tonnes, according to most estimates) and were prepared to do business at what amounted to substantial discounts in comparison to earlier in the year.

Brazil accounted for the greatest adjustment in our April review of global production estimates for the 2022/23 season. While the official forecast from CONAB was again reduced in during the month, a spell of near-perfect weather helped maturing plants and prompted other observers to improve their assessments of yield ahead of harvesting in June. Cotton Outlook increased its forecast for output by 100,000 tonnes to 2.9 million. However, that addition to the balance sheet was offset in large part by yet another reduction for India (this time of half a million bales of 170 kgs), to 30.5 million. Although it is undoubtedly true that farmer retention has been more prevalent than usual this season, the steady stream of arrivals (above 100,000 lint equivalent bales per day for several months) still seems insufficient to restore the optimism that abounded last summer, when a planted area above 12 million hectares and an apparently benign pattern of Monsoon rainfall inspired output forecasts above 35 million bales.

Meanwhile, for the 2023/24 crop, the persistent drought in West Texas caused many analysts to adjust their expectations of abandonment and yield in a state that accounts for well over half of the entire area planted to cotton in the US. Cotton Outlook adopted the planting figure contained in the March Prospective Plantings report for all states except California, but increased our view of abandonment to 40 percent, for a resulting output figure of just short of 14.9 million bales (480 lbs), compared to 15.6 million in March.

With regard to consumption, the global economic outlook’s failure to improve, and even to worsen (as discussed above) focused attention on some major cotton importing markets in Southeast and South Asia – notably Indonesia, Vietnam and Pakistan. Consumption estimates in the season ahead for the three countries named were reduced by 200,000 tonnes in aggregate.

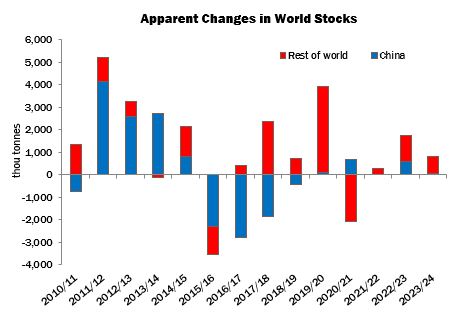

In light of these adjustments, our reckoning of world output fell by a modest 5,000 tonnes for 2022/23 and by the much more substantial figure of 156,000 tonnes for 2023/24, to 24.9 million tonnes and 25.2 million respectively. Consumption for the current season fell to 23.2 million tonnes and for 2023/24 to 24.4 million. Thus, over the course of the two seasons, stocks were predicted to rise by more than was projected in March: the increase for 2022/23 was estimated at 1.67 million and for 2023/24 it was 885,000 tonnes.