March 2024 Market Summary

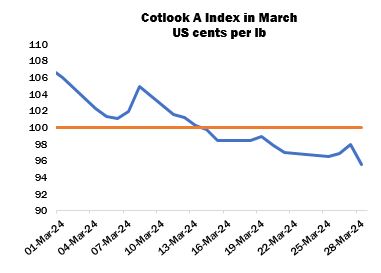

A fairly steep downturn was observed on the ICE cotton futures platform during March, reversing the upward trajectory that had begun in January. The May contract registered a net loss of 819 cent points on the month, closing at 91.38 cents per lb. Some volatility was nonetheless witnessed, including limit moves first up and then down on March 7 and 8, before generally more stable conditions returned. Turnover and open interest remained substantial. The inverted July/December spread meanwhile narrowed somewhat, to 800 cent points by March 28. International cotton prices, as measured by the Cotlook A Index, followed the overall downward trend of New York. The Index ended the period at 95.60, a fall of 1,140 points.

The basis levels offered for non-US growths, particularly Brazilian, were eroded over the month as merchants were wary of the wide inverted July/December spread and the subsequent burden of carrying positions, as well as of the competition between abundant supplies from various origins for a share of business. The reduction prompted some sporadic mill demand, particularly from those with gaps in their coverage and when prices in New York fell closer to the more palatable 90-cent level. Furthermore, despite cheaper offers for other origins, US supplies continued to see demand from some markets such as Turkey, perhaps on quality considerations, while discounts were also obtainable for lots not tenderable in New York.

As anticipated, USDA’s March WASDE report included a reduction of about 300,000 bales to the US production estimate for the current season. As a result, projected ending stocks were lowered to 2.5 million – the second lowest since the turn of the century. Despite the disparity between US and other origins, new export sales continued to be registered during March, cancellations were relatively modest and shipments were strong.

Turkey, Bangladesh, Pakistan and certain Far Eastern markets featured as relatively active buyers during the month in view, seeking to cover against nearby requirements with competitively priced lots, albeit in small volumes. However, spinners were wedded to a hand-to-mouth approach and many preferred to wait for greater stability in the futures market.

The May contract on the Zhengzhou cotton futures market in China declined too during March but in a much more moderate fashion, closing the last session on March 29 at 16,040 yuan per tonne (down 160 yuan on the month). The adjusted A Index had thus moved to a discount against the China Cotton Index by the end of the month, but import demand continued to be slow as local supplies and consigned lots remained abundant while offtake for yarn was slow and stock levels therefore increased. Early planting of the new crop began in parts of Xinjiang.

In the United States, the Department of Agriculture released its Prospective Plantings report for the upcoming season on March 28. The report indicated that the area planted to cotton in 2024/25 could rise by four percent from last season to 10.7 million acres, slightly below the figure put forward by the Department in February (11 million), but significantly higher than that offered by the National Cotton Council last month (9.8 million, based on surveys conducted when New York futures were at much lower levels). Nevertheless, sowing has barely started and the outcome will of course be influenced by factors including the weather. Most private commentators favour a plantings figure above 11 million acres. The month in view saw soil moisture levels decline in west Texas under hot and dry conditions, while planting progressed well in the south of the state.

Meanwhile, seed cotton arrivals continued in India, albeit at a slower pace. The most recent figure put forward by the Cotton Corporation of India placed deliveries at 23.9 million bales by March 18, representing 77 percent of anticipated total output. The Cotton Association of India increased it estimates of domestic production and consumption for 2023/24, to 30.97 million bales and 31.7 million, respectively. In Pakistan, early cotton sowing continued to expand and young crops progressed well under generally favourable conditions. The relatively high price levels maintained in March were thought to be encouraging early planting, and some advance business for new crop had already been concluded. In its final report for the season, the Pakistan Cotton Ginners’ Association placed total seed cotton arrivals at 8.4 million lint equivalent bales.

In the Southern Hemisphere, the Brazilian crop generally developed well during the month, although some fields required more moisture. CONAB increased its official crop forecast to 3.56 million tonnes, which would be a record output by some distance. Mostly hot and dry conditions persisted in Argentina, putting stress on plants in areas that had received inadequate rainfall. Harvesting progressed at a slow pace in its early stages but is expected to accelerate in April. Picking began in parts of Australia and standing crops in both dryland and irrigated fields were said to be faring well overall.

Cotlook’s forecast of global raw cotton production in 2023/24 was revised upward by 187,000 tonnes, as an addition for Brazil was only partially offset by a decline for the United States. The estimate for 2024/25 was increased by 20,000 tonnes, attributed to the African Franc Zone. Our consumption figures were also upwardly adjusted for both the current and upcoming seasons, by 340,000 and 360,000 tonnes, respectively. In both cases, the changes were a result of higher estimates for China and India. Therefore, world ending stocks are expected to rise by 601,000 tonnes by the end of the current season, and 95,000 by July 31, 2025.