ICE No. 2 cotton settles mostly on modest losses

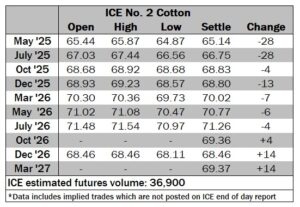

Nearby months ended between 4 to 28 points lower while forward months gained modest ground. May ’25 futures opened 65.44 cents/lb (+2) and gained ground during the first several hours, moving to a high of 65.87 cents/lb (+45) around 0835 GMT. Resistance was met and the spot month had a mixed tone over the next few hours before meeting additional resistance and falling to a low of 64.87 cents/lb (-55) by 1645 GMT. May cotton moved off its low but traded in the bottom half of its range over the rest of the session to settle at 65.14 cents/lb (-28).

ICE estimated volume at 36,900 contracts, higher than yesterday’s 35,672. At the time cotton settled, the US dollar was trading lower, as well as corn, soybeans and wheat.

Total open interest rose by 4,370 contracts to 282,273, its highest level since February 13. May ’25, July ’25, December ’25 and March ’26 interest increased by 1,943, 1,955, 408 and 84 contracts, respectively, to 131,627, 74,830, 66,861 and 5,153.

Certificated stocks were last reported at 14,488 bales, unchanged and remaining at its highest level since January 14 (20,113). There were no bales awaiting review and no bales reported in both cert stocks and CCC loan as of March 24.

Posted in: Cotlook Headlines News

Leave a Reply

You must be logged in to post a comment.